15-12-2025

There are numerous modern mobility-tech providers that can offer taxi dispatch software that has integrated payment processing access. These providers also offer an all-in-one solution, ride-hailing, and fleet management business. Many robust platforms are capable of providing built-in payment gateways and support digitized wallets, credit or debit cards, and region-specific UPI. These options will help the passengers to make seamless payments and help with automating fare settlement. This dispatch software platform should include a passenger app, an admin panel, a driver app, real-time tracking, automated dispatching, fare calculation, and secure payments. Top service providers that offer customizable and scalable systems that are suitable for small to large fleets include UnicoTaxi, AllRide apps, and many more white-label companies.

Tired of failed and secured payments? Wondering where to find the dispatch platform that offers built-in payment? In the fast-paced world, taxi businesses don’t just assign drivers; they need an all-in-one platform that can assign, track, and book seamlessly within it. This is why most of the taxi entrepreneurs are looking for modern dispatch software that supports payment integration, digital wallets, and automatic fare settlements. Several software providers offer these solutions and help run smart, smooth, and efficient taxi operations.

The modern dispatch system plays a key role in streamlining the entire riding experience, right from booking to billing, including integrated payments. People these days are relying on digital payment systems and avoiding cash and manual fare calculation, as it is an unreliable source. With the help of these built-in gateways, customers can pay through cash, wallets, or other payment methods, which will help in fast and secure transactions. Using these methods will reduce payment disputes and eliminate revenue leakage.

This will help the owner to maintain an accurate financial record, and the driver's payouts will be automated. In the case of passengers, the use of integrated payment means convenience and trust. For businesses, this solution will perform smooth operations, improve cash flow, and provide professional service. Having a reliable and secure payment gateway is essential in the modern taxi business, as it provides a seamless, frictionless taxi riding experience.

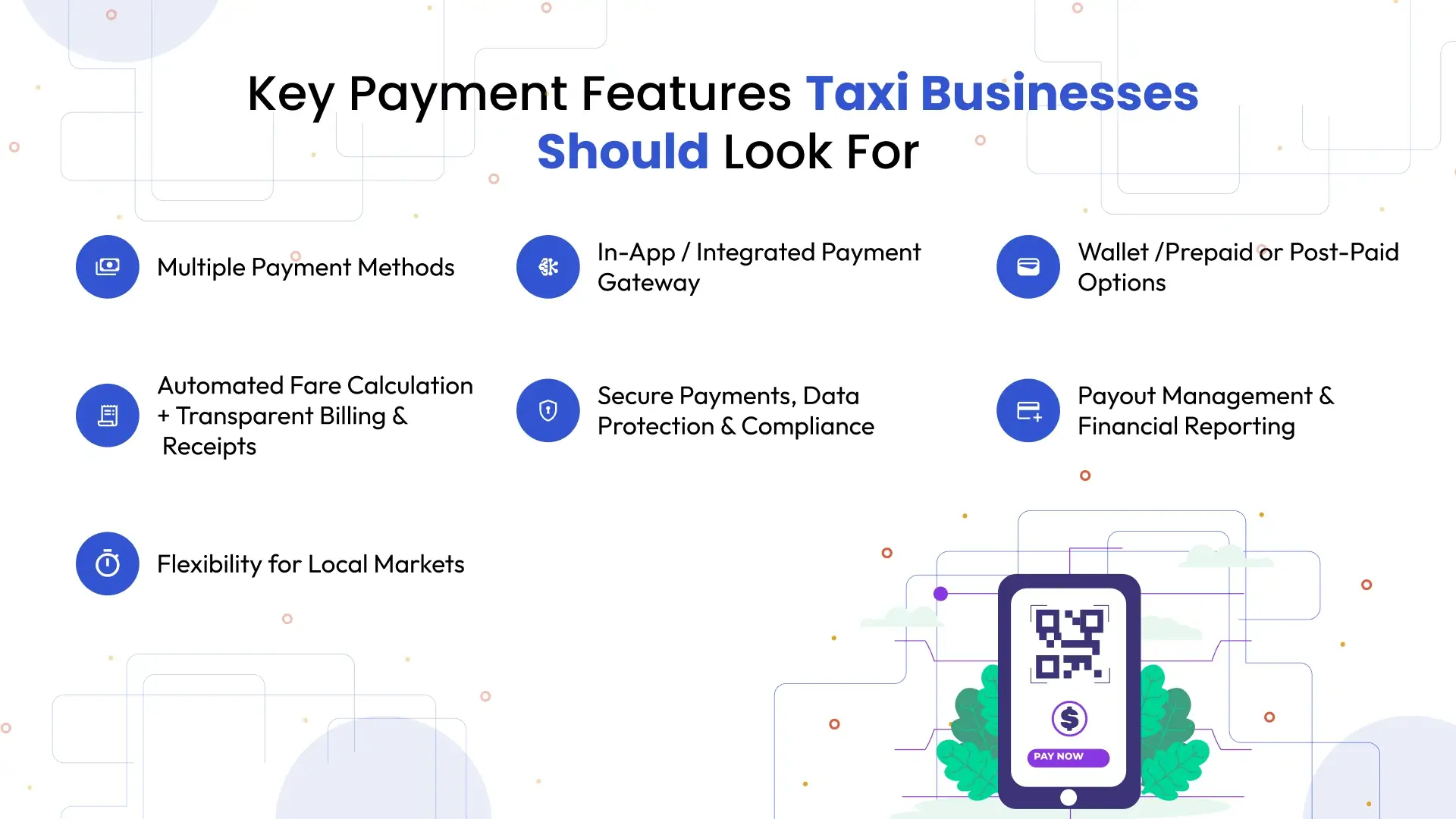

A reliable payment solution should support multiple payment methods like credit/debit cards, mobile wallets, digital payments, and other local payment methods.

People can use this flexibility to increase their convenience and reduce friction.

If the payment system is built within the app or dispatch solution, the customers can easily make their payment at the end of the trip, without relying on cash or manual methods.

This will help both the customer and the driver to have hassle-free, speedy turnover and smooth operations.

Having a wallet system in your software will help the customers to preload funds and give flexibility. Funds can be topped up in advance, driver pay can be paid electronically, and the operators can offer wallet payment for faster transactions.

Some system supports a fixed rate, and some support a dynamic one based on your business model.

Fare calculation is based on waiting charges, distance, time, surge pricing, and much more. The system should also generate a transparent breakdown and an invoice for each ride.

This will help in building trust and reducing disputes.

The platform should also be able to provide high-level security, as the financial data is sensitive information. The system should also comply with data security and safeguard customer details and information.

When the payment system is robust, you can easily keep track of the driver earnings, manage payouts, adjust cancellations, and track ride history. This will help the finances to be transparent and clean. This will eventually reduce the manual booking headache.

If you are operating in a specific region, then the taxi management system should support the regional gateway, wallets, and payment methods.

Also Read: 5 Popular Payment Gateways to Improve Your Taxi Booking App

Using the cashless payment methods like in-app payments and wallets, the operators can improve the payment processing faster, seamless, and stress-free. Why carry cards, cash, and change when you can make the payment with just a tap of an app? The users can easily load cash into their wallets, store their preferred transaction model, and enable quick checkouts and smooth ride completion. This will highly reduce the waiting time at drop-off points and ensure payment without fail and disputes. Frequent customers will get perks like promo credits, instant refunds, and ride history tracking. These benefits will enable customers to enjoy a reliable, modern, and comfortable taxi experience.

Most of the operators offer multiple payment gateways, which will offer flexibility. There are two types of gateways, including domestic and global. Sometimes it combines both and offers a hybrid approach, which will support local and global gateways. This approach will be beneficial for tourist-prone areas with higher traffic. Here, we will discuss the common gateways used.

The most common and popular gateways internationally. This will support multiple currencies, credit or debit cards, and digital wallets, and offer a developer-friendly API. This is good for international operators that need to handle foreign clients.

This is also a trusted platform across the globe. This will support payment methods like cards, wallets, international payments, and small payouts. This is highly useful for cross-border transactions.

This includes Adyen, which will offer fraud detection and prevention, multiple payment methods, saved cards, and scalable infrastructure. Braintree supports cards, PayPal, Apple Pay, and Google Pay. Suitable for subscription and marketplace models. Checkout.com has a strong global coverage, supports high authorization rates, and is popular with fast-scaling platforms. Worldpay accepts payments in many countries and supports cards and alternative payment methods. 2Checkout is an easy international payment acceptance, and also supports multiple currencies and regions.

User trust and reliability will be shaken by security, compliance, and fraud prevention. The modern apps handle the sensitive financial data, make it available for use using smart encryption, and tokenization. PCI-DSS compliance will be used to protect wallet and card data. To make the transactions legally sound and reduce penalties, your business should abide by the regional regulations, like the protection law and financial standards. Using the built-in fraud detection tools, including real-time transaction monitoring, secure authorization, and automated chargeback, you can easily reduce suspicious activity and revenue loss prevention. With the help of secure and compliant payment processing, businesses can safeguard user data, reduce risks, and deliver a trustworthy payment experience for riders and drivers.

Analytics can be used to gain information on clear, data-driven insights, which will give data about revenue performance and rider behavior. Transactions are analyzed, and the operators track popular routes, peak booking times, average ride values, and preferred payment methods. This will help in fixing perfect pricing and making operational decisions. The rider pattern can be obtained from the payment data. Information like repeated usage, cancellations, wallet top-ups, and refund trends. When it comes to revenue, this data can be used for tracking driver earnings, commissions, surge pricing, and cash flow, as it reduces guesswork. If you are using the payment analytics effectively, it can be used to run every transaction into valuable data. This will allow the operators to optimize services, improve experience, and grow profitability.

With the help of technology, UnicoTaxi uses GPS tracking and live maps to track down and monitor all the current trips, including the location of the driver, the route they travel, and the pickup and drop-off locations. This will help with quicker reassignments and rerouting if needed.

Taxi businesses should balance between cash, cards, and wallets when they are willing to serve diverse riders and keep the operators efficient. Most of the customers started using payment and wallets for quick, transparent, and easy record-keeping, but some still use cash payments in certain regions. If you are using a flexible payment system in your dispatch solution like UnicoTaxi that supports all these options, it offers the most convenient, frictionless, and improved satisfaction. Some operators like UnicoTaxi can integrate cards and wallets using the app, which will help them to track accurately, minimize disputes, and simplify driver payouts. But the cash can ensure no ride is lost due to transaction limitations. Striking the right balance between traditional and digital payments enables taxi businesses to meet customer expectations, adapt to local preferences, and maintain smooth, future-ready operations.

There are some important questions to ask before choosing the right question that will support your business goals and daily operations.

Start by evaluating if the platform supports cash, cards, and digital wallets so that the customers can have numerous choices.

Ask how secure the transactions processed are and make sure that the software complies with the PCI-DSS regulations.

Understand how the payouts are handled, how fast the settlements occur, and whether the system provides payment reports and analytics.

Lastly, consider how the platform synchronizes with the existing tools, can it scale, and the level of technical support that is available in the platform.

These questions can upfront and help you choose the best taxi dispatch software that can offer built-in online payment options.

Kiruthika is a Senior Content Writer at UnicoTaxi. She has been in the content writing industry for over 5 years and works closely with taxi, mobility, and on-demand delivery businesses. She understands the pulse of the transport tech industry, researches evolving market trends, and creates content that educates, informs, and drives growth. Kiruthika is passionate about storytelling, loves simplifying complex topics, and enjoys connecting with readers through impactful writing.